The Commonwealth Bank has reported a yearly cash profit increase of 6 percent—to a record $10.2 billion—as working-class borrowers continue to be throttled by higher interest rates and declining savings due to price rises.

The CBA’s results, which will be followed in November by the three other major banks (ANZ, Westpac and NAB), come on the back of soaring profits in the last reporting season.

According to accounting consultancy KPMG, the Big Four increased after tax cash profits by 55 percent in 2021, and by 6.5 percent last year, to a combined $28.5 billion.

Most of the recent reporting on the cost-of-living crisis has focused on the disinflationary dynamic that has taken hold in the economy as the consumer price index has fallen from its December peak of 7.8 percent to 6 percent in the most recent June figures.

That’s still more than two points above the annual wage growth of 3.7 percent, meaning that real wages continue to be pushed down. Nevertheless, the decline in headline inflation has generated optimism that the worst is behind us.

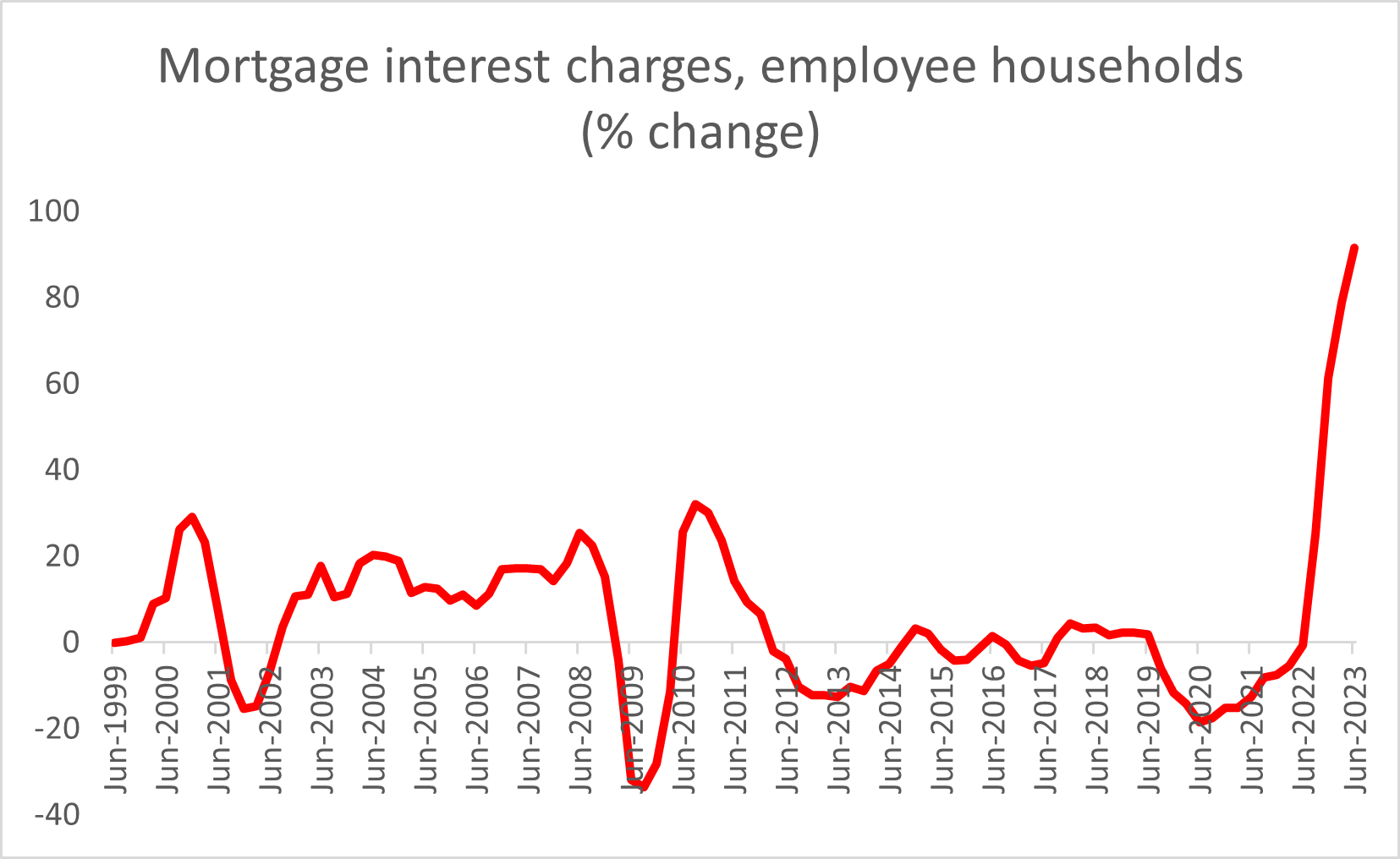

Yet the paradox, for many households, is that the biggest contributor to increased living costs is higher mortgage payments coming from the rise in interest rates.

The consumer price index doesn’t count this cost—partly because rising interest rates are the Reserve Bank’s weapon to bring down inflation. That is, the very thing that is supposed to slay the cost-of-living dragon is, perversely, feeding it like nothing else for indebted households.

So what do things look like when interest is considered in the equation?

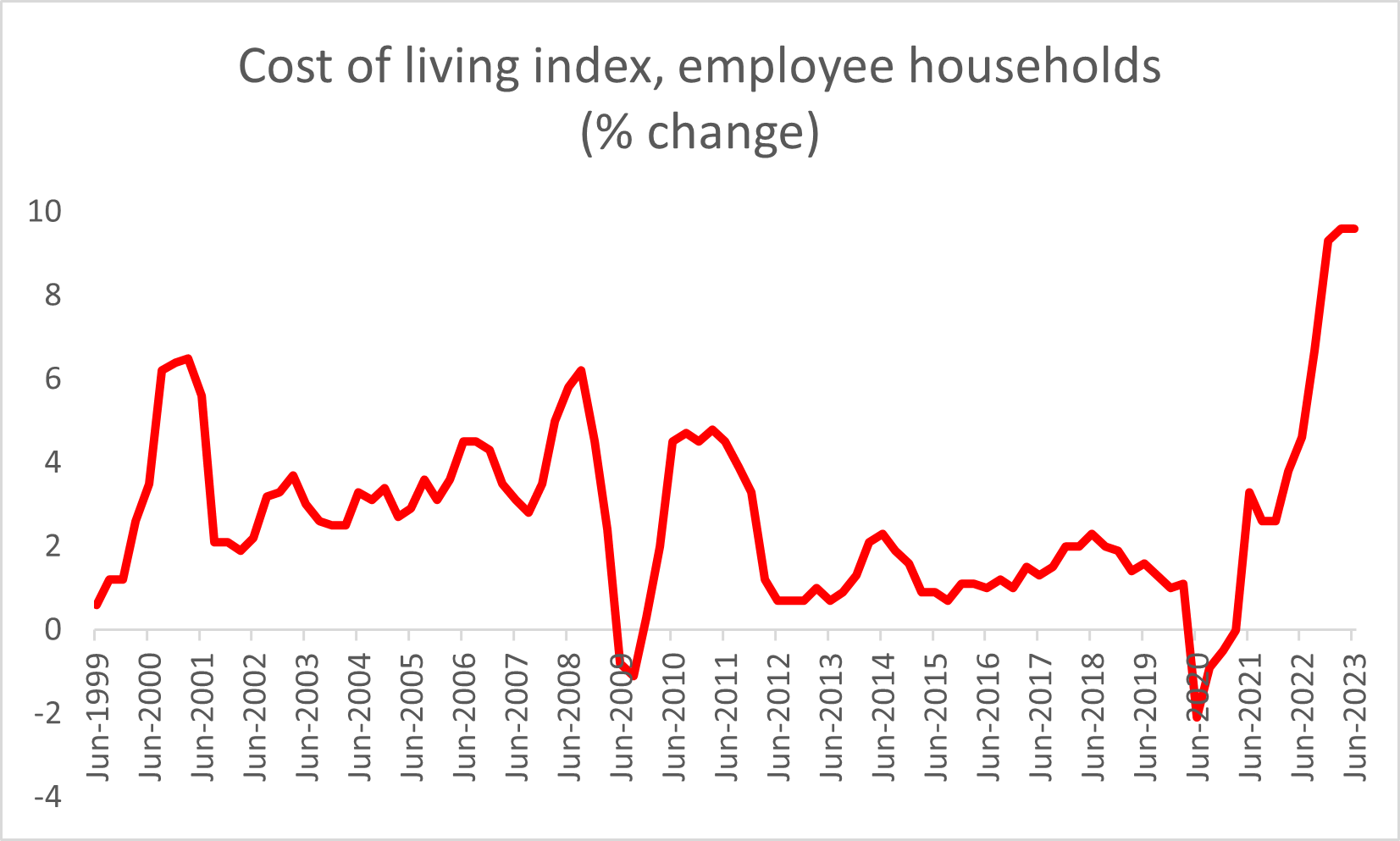

The Bureau of Statistics’ selected living costs indexes—which, unlike the CPI measure, show the effects of rising rates—provide a stark rejoinder to the talk about “easing” pressures.

According to the Bureau’s latest figures, employee households (those who depend on wages to pay the bills) are being smashed even as inflation has moderated.

In the last year, for example, the cost of living has climbed by 9.6 percent. For pensioners, it’s up 6.7 percent.

In fact, in the last 12 months, all household types faced rising living costs that were “equal to or higher” than the consumer price index.

“The rise in annual living costs for employee households is the largest increase since this series started in 1999. The last time the CPI recorded an annual increase of 9.6 per cent was in 1986”, Michelle Marquardt, ABS head of prices statistics, said in a media release last week.

And the rise has been underpinned by the banks increasing the interest rate on home loans.

Mortgage interest charges rose on average by nearly 92 percent over the last year, according to the Bureau’s figures.

The banks’ skyrocketing profits, then, are coming directly at the expense of working-class households.

As Israel’s latest brutal war against the people of Gaza drags on, the need to challenge the Zionist state and all those who facilitate its genocidal campaign couldn’t be clearer.

In the latest outburst of national security hysteria, ASIO spy chief Mike Burgess declared, in a speech on 28 February, that an unnamed former Australian politician had betrayed our beloved country by clandestinely working for an evil foreign spy network—which he called “the A-team”—to provide secret information to a rival power.

Measured by the sheer volume of stuff produced, capitalism is a very successful system. According to World Bank data, in 1960 global gross domestic product (GDP)—which measures the monetary value of goods and services sold—was just under US$1.4 trillion. By 2022 it had risen to $101 trillion. The world’s population has increased a lot in that time, but the volume of stuff produced has increased by far more.

Banyule City Council has become the eighth metro council in the Melbourne area to formally call for an immediate ceasefire in Gaza.

In a monumental betrayal, Melbourne University’s Students’ Council last month voted to rescind a motion supporting the Palestinian struggle for self-determination and the global Boycott, Divestment, Sanctions movement.

The year is 2070. A global catastrophe—climate change, nuclear winter, civil war: pick your poison—recently ended civilisation and opened a new chapter in your life. So far you’ve ridden it out smoothly in your luxury bunker, but one day you’re swimming laps in the pool, living out your Bond-villain dream, when an alert blinks on your home security console.